Sukanya Samriddhi Yojana started in 22nd Jan 2015, the Government of India backed saving scheme targeted at parents of girl child.

The scheme was launched by PM Mr. Narendra Modi as a part of Beti Bachao, Beti Padhao campaign.

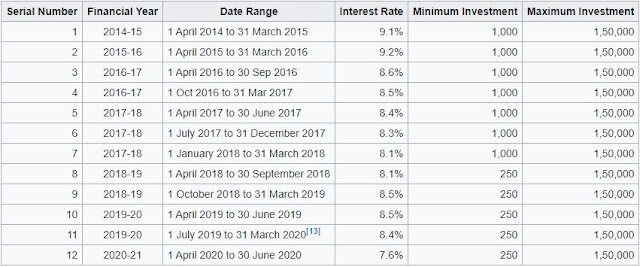

Sukanya Samriddhi Yojana provides the interest rate up to 8.6% and in these schemes the interest rate revised as per financial year.

1) How to apply for Suknya Samriddhi Yojana?

You can open the Suknya Samriddhi Yojana account at any nearest India Post Office or the nearest branch of some authorized commercial banks.The one account can be opened for one girl only anytime between the birth of girl child to time she attains 10 years of age by her parents or guardians.

You can start to Suknya Samriddhi Yojana with Rs. 250 as an initially amount, thereafter the user can deposit any amount in multiples of Rs. 100 the maximum deposit limit is Rs. 150,000.

If you missed to deposit a minimum amount of Rs. 250 in Suknya Samriddhi Yojana, you will be fined Rs. 50.

2) Sukanya Samriddhi Yojana Rights :

- The girl can operate her account after she turned to age 10 years.

- The girl can withdraw 50% of the amount at the age of 18 for higher education purposes.

- The account reaches maturity after a time period of 21 years from the date of opening it.

- If the girl is over 18 and gets married she allowed to close the account.

3) Tax benefits for Sukanya Samriddhi Yojana:

The deposits in the account were eligible for tax deduction under section 80 C, which is Rs. 150,000. The benefits will be reassessed annually.In Sukanya Samriddhi Yojana the account may transferred anywhere in India from India Post Office or Bank